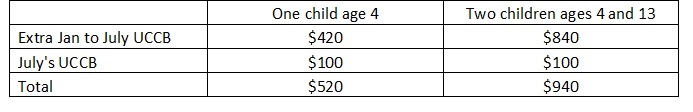

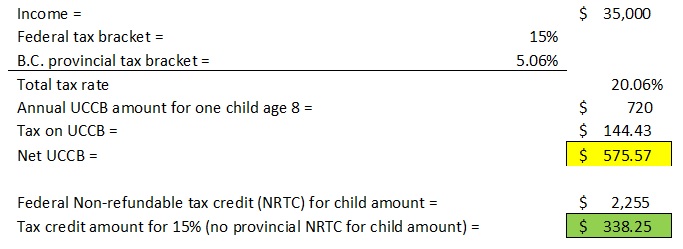

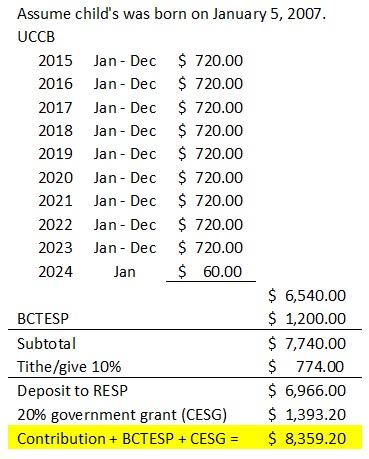

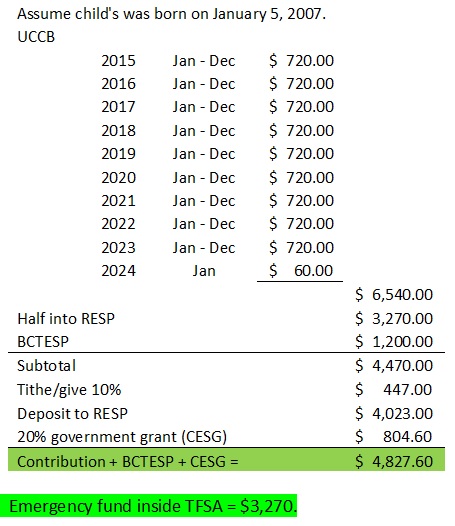

Image courtesy of Stuart Miles at FreeDigitalPhotos.net. One of the hot topics for parents nowadays is the lump-sum Universal Child Care Benefit (UCCB) money that they just collected. What to do with the money? If you are into politics, does this buy your vote for the current government come election time in October? Well, since this newsletter is about managing money, we will stick with the money management part. So, let’s see how much money you received. If you are a parent of a child age 17 and under, you should have received a lump sum of $60/child/month for retroactive payments from January to July 2015. This means, you received a lump sum of $420/child. Here are two scenarios of payments you would have received this month. From now on, you will get additional $60/month for each child age 17 and under, unless the government changes its policy. You should know that the UCCB money is taxable. This means that you need to report the amount as your income when you file your 2015 tax return. I have heard unhealthy information scaring people that the money is worthless, because this cash will replace the non-refundable tax credit (NRTC) of child amount ($2,255 for 2014 tax). If you want accurate information, you would have to do the calculation based on your family situation. Let me do 2 case scenarios – one for a person in the lowest tax bracket, and another for one in the highest tax bracket. As you can see, for someone in the lowest tax bracket in B.C., the net cash is greater than the tax credit lost for the child amount. He/she gains $$237.32. Below is another scenario for someone earning $160,000, who is in the highest tax bracket. Here, again we see that the net UCCB is still higher than the tax credit, although not as much as a person in the lowest tax bracket (gain of only $51.99). You should also know that Non-Refundable Tax Credit (NRTC) is only useful if you have taxable income. The credit can be used to reduce your tax, but if you have no tax to be paid, then the credit is useless. What about stay-at-home parents? If a parent has no other income, the UCCB is not taxable at all. Why? Because everyone has basic personal amount of NRTC of $11,138 (in 2014), this means the first $11,138 income is not taxable. By the way, the basic personal amount is adjusted every year based on inflation. Thus, you will see a higher number for 2015 tax. If you have any questions on how the UCCB payment impacts you or if you would like me to calculate the net effect for you, please do let me know. Send me an email ([email protected]). Hopefully after reading all of the above, you now have better understanding of the net UCCB cash in your pocket. The next question is, what to do with the money? Here are some suggestions based on one’s personal financial situation. 1. RESP If you have no other debts besides mortgage and you have an emergency savings fund already, I would recommend putting the money into Registered Education Savings Plan (RESP). Why? Because UCCB was meant to help you with the cost of raising your child. So, it should be used for your child. Anyway, inside RESP, not only will the money grow tax free, but you will also get at least an additional 20% Canada Education Savings Grant (CESG) from the government. Now, who wouldn’t want free money? :) By the way, if your child was born in 2007 or later, please do take advantage of BC Training and Education Savings Program (BCTESP). It is B.C. government’s free $1,200 for your child’s college fund. If you want to find out more, just Google “BCTESP.” Below is an example of how much your UCCB money plus BCTESP plus CESG would amount to in 10 years (not including interest). I have taken a liberty to give away 10% of the money as tithe or giving to show that you can afford to do so. 2. TFSA and RESP If you have no other debts besides mortgage but you don’t have yet an emergency savings fund, I would recommend putting half of the money into a savings account (designated for emergency fund), and another half into RESP. You could park your emergency fund inside a Tax Free Savings Account (TFSA); this way, you will not have to pay tax on the interest generated. Now not only will you have college fund, but you also have an emergency fund set aside so you won’t rely on credit cards or loans when you have emergencies.

3. Emergency Fund (TFSA), Extra Debt Repayment, and RESP If you have debts other than mortgage and you have a little bit of emergency fund, I would recommend allocating part of UCCB money into your emergency fund, part of it into extra payment for the debts, and part of it into RESP. 4. Emergency Fund (TFSA) and Extra Debt Repayment If you have debts other than mortgage and you have NO emergency fund, I would recommend allocating part of it into your emergency fund, and part of it into extra payment for the debts. Please do not spend the emergency fund other than for emergencies (loss of a job, illness, etc.). I hope this information has been useful for you. Do let me know of your comments or questions. Enjoy the rest of summer!

2 Comments

17/11/2015 16:45:17

The advantage to having the UCCB is parents can spend the money where they want. The UCCB is universal which helps all families as well as it subsidizes some of the cost of childcare. The main disadvantage to the UCCB is that it doesn’t cover the full cost of childcare, not even half the cost of childcare and more over its taxable.

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

AuthorCommitted to help clients to be literate about their personal financial situations, to reduce their money-related stress, and to help them achieve their financial goals. Archives

March 2025

Categories |

RSS Feed

RSS Feed